kansas dmv sales tax calculator

If purchased from a Kansas Dealer with the intention to register the vehicle in Kansas the sales tax rate charged is the combined state and local city county and. This will start with a recording.

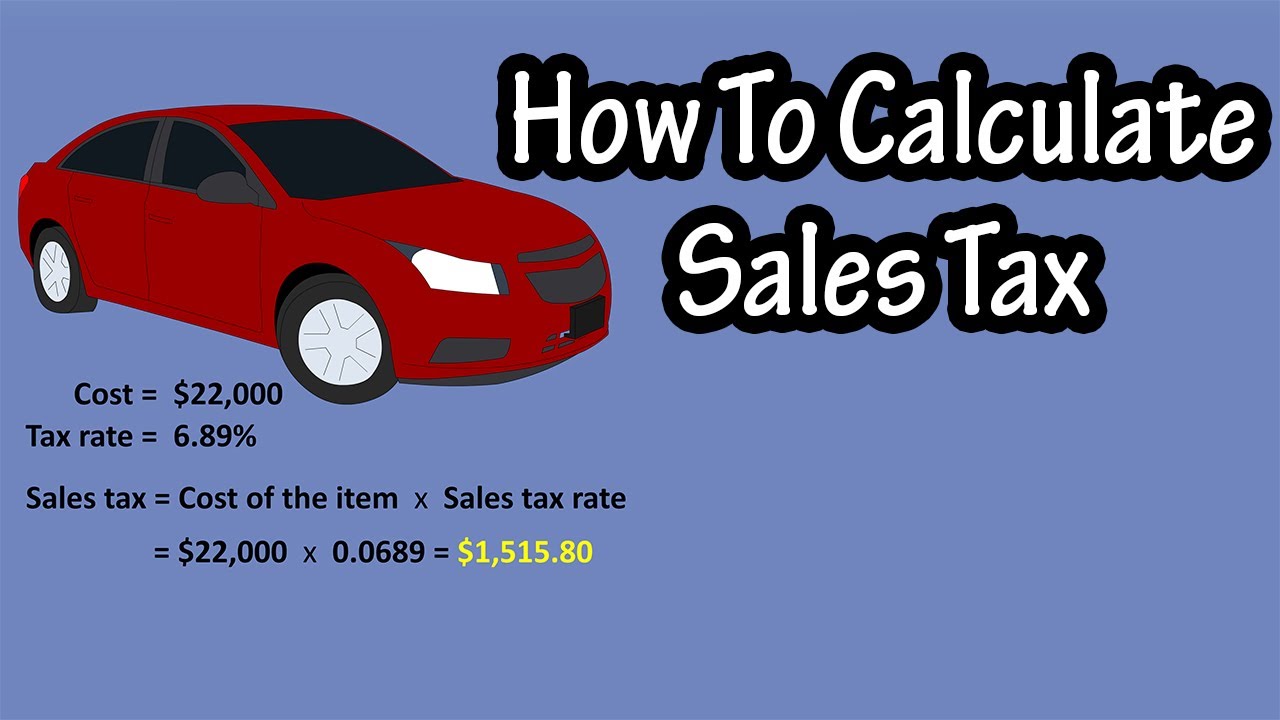

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts.

. Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By. Vehicle Tags and Titling What you need to know about titling and tagging your vehicle. Subtract these values if any from the sale.

To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator. Vehicle Property Tax Calculator Estimate vehicle property tax by makemodelyear or VIN. Once you have the tax.

Calculating Sales Tax Summary. Vehicle Tax Costs. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

Vehicle tax or sales tax is based on the vehicles net purchase price. To get the difference you will need to contact the county treasurer and give them the year. Tax Season Vehicle License Fee VLF paid for tax purposes Select a Calculator to Begin Registration renewal fees Registration fees for new vehicles that will be purchased in California from a licensed California dealer Registration fees for new resident vehicles registered outside the state of California Registration fees for used vehicles that will be purchased in California.

How much is sales tax on a vehicle. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year.

The median property tax on a 20990000 house is 270771 in kansas. For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000. Contact your County Treasurer for an closer estimate of.

Motor vehicle titling and registration. Burghart is a graduate of the University of Kansas. The state general sales tax rate of missouri is 4225.

Kansas has recent rate changes thu jul 01 2021. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Sales tax will be collected in the tag office if the vehicle was bought from an individual or purchased out of state.

Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. These fees are separate from. Kansas has a 65 statewide sales tax rate but also has 376 local taxsales tax rate but also has 376 local tax.

Shawnee County is the third largest county in the state of Kansas and is the home of the capital city Topeka. Kansas city vehicle sales tax calculator. You may pay a sales tax the first time you register a new or used vehicle if purchased from an individual or an out of state dealer.

Home Motor Vehicle Sales Tax Calculator. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. Dealership employees are more in tune to tax rates than most government officials.

For the sales tax use our sales tax rate lookup. Motor Vehicle Office Locations. If you are unsure call any local car dealership and ask for the tax rate.

The sales tax rate varies by County. May 10 2021 and november 10 2021. Johnson county kansas vehicle sales tax calculator.

For your property tax amount refer to County Treasurer. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. The kansas state sales tax rate is currently 65.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 635 for vehicle 50k or less. Learn more about Shawnee County in the Visitors CenterFind out about local attractions institutions and more.

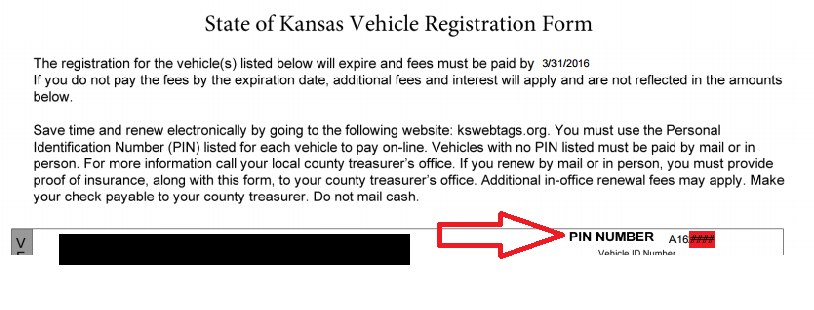

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. This will be collected in the tag office if the vehicle was purchased from an individual or an out-of state car dealer. This will be collected in the tag office if the vehicle was purchased from an individual or out-of-state car dealer.

Vehicle Property Tax Estimator. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. You pay tax on the sale price of the unit less any trade-in or rebate.

For additional information click on the links below. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. For the sales tax use our Sales Tax Rate Lookup.

You cannot register renew or title your vehicles at the Treasurers office located in the County Administration Building in Olathe. Kansas Documentation Fees. Motor vehicle title.

Title fee is 800 tag fees vary according to type of vehicle. Also check the sales tax rates in different states of the us understand the forms of sales taxes used in. Its fairly simple to calculate provided you know your regions sales tax.

DO NOT push any buttons and you will get an information operator. Average DMV fees in Kansas on a new-car purchase add up to 39 1 which includes the title registration and plate fees shown above. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984.

The rate in sedgwick county is 75 percent. Kansas has a 65 statewide sales tax rate but also has 376 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1552 on top.

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Faq S On Personal Property Crawford County Ks

Missouri Car Sales Tax Calculator

California Vehicle Sales Tax Fees Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Sales Tax On Cars And Vehicles In Kansas

Motor Vehicle Fees And Payment Options Johnson County Kansas

Dmv Fees By State Usa Manual Car Registration Calculator

Pay Vehicle Tax Registration Crawford County Ks

What S The Car Sales Tax In Each State Find The Best Car Price